Four Reasons Bitcoin Is Dumping Before BTC Halving

- BitcoinCrypto

- April 3, 2024

- No Comment

- 9

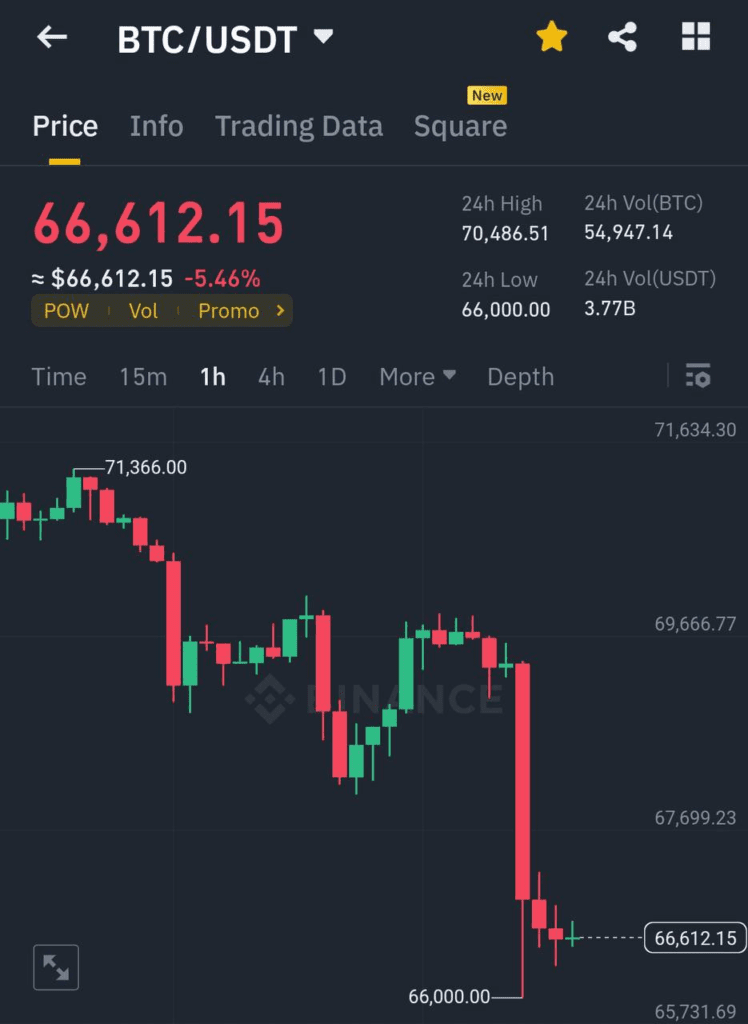

Bitcoin, the world’s leading cryptocurrency, has experienced a recent downturn, leaving investors and enthusiasts wondering about the reasons behind its decline. Based on an X tweet by Ash Crypto @Ashcryptoreal on X. Here are four key factors that could help explain the current dump in Bitcoin prices.

Grayscale Outflow:

Grayscale, a prominent cryptocurrency asset management firm, witnessed a significant outflow of $302 million, accompanied by a net outflow for Bitcoin Exchange Traded Funds (ETFs). Notably, there appears to be ongoing substantial selling of the Grayscale Bitcoin Trust (GBTC), possibly from Genesis, a digital currency trading firm. Once this selling pressure subsides, Bitcoin is expected to regain its upward momentum.

Excessive Leverage:

Market whales, who hold substantial amounts of cryptocurrency, have a tendency to liquidate high-leverage long and short positions. Presently, open interest (OI) in the Bitcoin market has reached new highs, alongside a positive funding rate, indicating a larger number of long positions compared to shorts. In response, whales are liquidating these long positions as they have done in the past.

Pre-Halving Correction:

Bitcoin has historically experienced a decline before halving events, and the current situation is no exception. Halving refers to the programmed reduction in the rate at which new Bitcoin is created. This anticipated correction is a common phenomenon, and it is widely believed that Bitcoin will resume its upward trajectory after the halving.

Macro Factors:

An interesting correlation has emerged between Bitcoin and the 10-year US Treasury yield. Recent data indicates a negative correlation of -90%, indicating that whenever the 10-year Treasury yield rises, Bitcoin tends to drop. Yesterday, the 10-year Treasury yield saw an increase of 4.3%, which contributed to the decline in Bitcoin prices.

As Bitcoin investors navigate these market dynamics, it is essential to consider the interplay of these factors while making informed decisions. While short-term fluctuations may cause concern, many in the crypto community remain optimistic about the future prospects of Bitcoin as a store of value and a medium of exchange.