Bitcoin Still Down Despite Halving: When Will the Real BTC Bull Run Start?

- BitcoinCrypto

- April 18, 2024

- No Comment

- 16

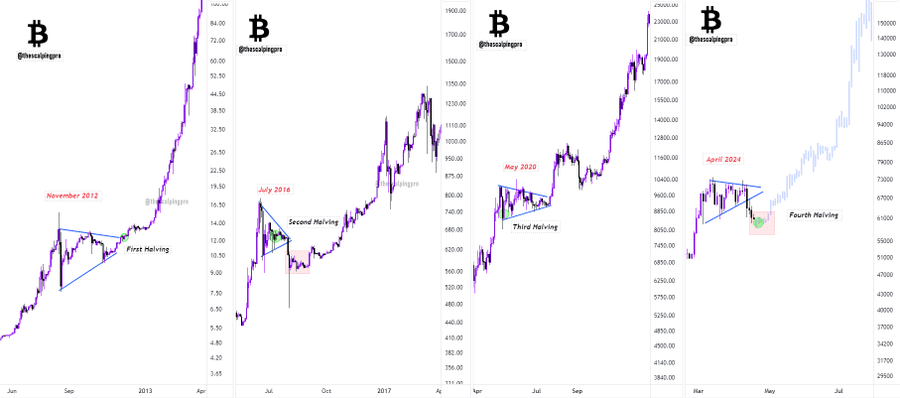

The long-awaited Bitcoin halving event is already here, but the crypto market remains bearish, leaving many investors wondering when the real bull run will begin. The halving, which occurs every four years, reduces the rate at which new bitcoins are created, thereby decreasing supply over time. Historically, this event has been followed by significant price rallies, as the reduced supply coupled with steady or increasing demand drives up the value of Bitcoin.

However, as pointed out by popular crypto trader and analyst Mags (@thescalpingpro), volatility and sideways trading often precede any substantial post-halving price surge. “During each halving event, we’ve witnessed some volatility before or after the halving event,” Mags explained.

Drawing parallels to the 2016 halving, Mags noted that the current price action resembles the period following that event, where Bitcoin experienced a pullback and traded sideways for several months before embarking on a prolonged bull run.

“After the recent dump, the structure looks much similar to 2016, where the price took a pullback and went sideways for a few months after the halving event before it started pumping again,” Mags said.

The analyst cautioned investors against getting “shaken out” during this period of consolidation, emphasizing that the real bull run typically begins a few months after the halving. “Remember, what we’ve seen so far was recovery until the previous ATH. The real bull run starts a few months after the Bitcoin halving.”

For those unfamiliar with the term, an ATH (All-Time High) refers to the highest price level an asset has ever reached. In the case of Bitcoin, the current ATH stands at around $69,000, set in November 2021.

While the halving event is undoubtedly significant, history suggests that patience and a long-term perspective may be required before the full bullish effects manifest in the market. As the supply of new bitcoins dwindles, the focus will shift to demand dynamics, which could be influenced by factors such as institutional adoption, regulatory developments, and macroeconomic conditions.

In the meantime, traders and investors are advised to exercise caution and manage their risk exposure accordingly, as the crypto market is known for its volatility and unpredictability.