Why Ripple (XRP) Could Potentially Surge to $3 This Year

- News

- May 11, 2024

- No Comment

- 82

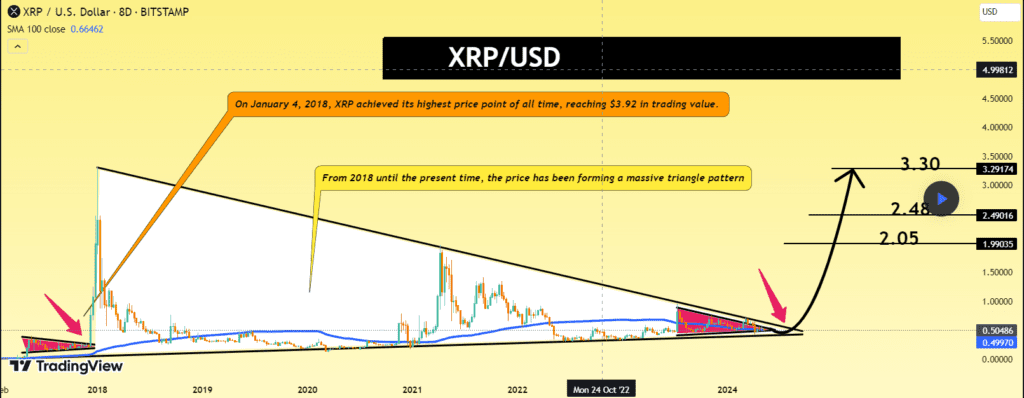

In a recent analysis on TradingView, an analyst, Kateryna highlighted the potential for Ripple (XRP) to experience a significant price surge in the coming months. The analyst’s perspective is based on the formation of a massive triangle pattern in XRP’s price chart since 2018, indicating a potential breakout to the upside towards the $2-3 level.

The Triangle Pattern and Its Significance

The analyst explains that the prolonged consolidation period reflected in Ripple’s price chart suggests a significant accumulation of market forces. A triangle pattern typically signifies a period of indecision, with buyers and sellers balancing each other out. However, as the pattern nears its apex, pressure builds, often resulting in a breakout.

In Ripple’s case, a breakout to the upside is anticipated, given the historical bullish momentum of the cryptocurrency market and the positive sentiment surrounding Ripple’s technology and partnerships. Quoting the analyst from TradingView, “Ripple (XRP) has been forming a massive triangle pattern since 2018, indicating a potential breakout to the upside towards the $2-3 level. This makes holding Ripple in your portfolio particularly relevant.”

Past Performances and Breakout Potential

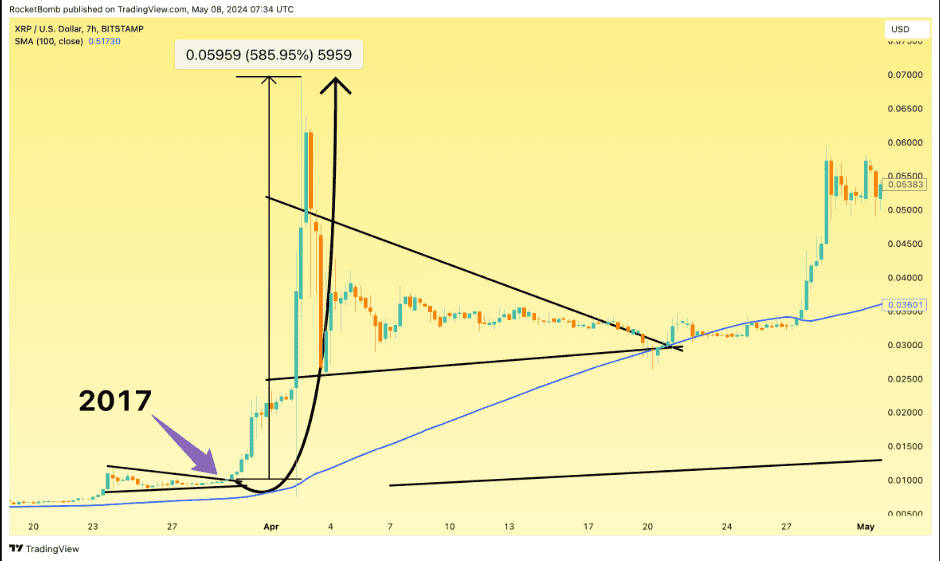

To confirm the typical price movement of Ripple, the analyst suggests examining the formations and breakouts from similar triangles in the past. In 2017, XRP experienced a remarkable surge of 1,400% in December, going from $0.00678 in January to $3.317 in January 2018, representing a 48,823% increase. At its peak, XRP briefly became the second-most capitalized cryptocurrency in the world after Bitcoin, reaching an all-time high of $3.84 on January 4, 2018.

However, as with many cryptocurrencies, XRP’s value plummeted after the crash in 2018, and as of May 3, 2024, it trades at around $0.50.The breakout from this triangle pattern could present a lucrative opportunity for traders and investors. A decisive move above the upper trendline of the triangle, coupled with strong volume, would confirm the bullish bias. Traders may consider initiating long positions targeting the $2-3 range, while investors could view this as a validation of Ripple’s long-term potential and consider increasing their exposure to the cryptocurrency.

Read Also: Ripple’s Legal Woes Intensify as SEC Rejects $10 Million Fine, Implications for XRP

The Ripple SEC Case: A Significant Factor

While the technical analysis and historical price movements suggest a potential upside for XRP, it is crucial to consider the ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC). The SEC alleges that Ripple’s sale of XRP constituted an unregistered securities offering, a claim that Ripple has vehemently denied.

The outcome of this case could significantly impact XRP’s price trajectory. If Ripple prevails, it would likely provide a substantial boost to XRP’s value, as it would remove a major source of regulatory uncertainty and potentially pave the way for wider adoption and integration of the cryptocurrency. Conversely, an unfavorable ruling for Ripple could deal a severe blow to XRP’s price, as it may dampen investor confidence and restrict the cryptocurrency’s use cases.