Top BTC Analyst Advises on What to Do as Bitcoin Sees Third Largest Coin Accumulation

- CryptoNews

- March 27, 2024

- No Comment

- 247

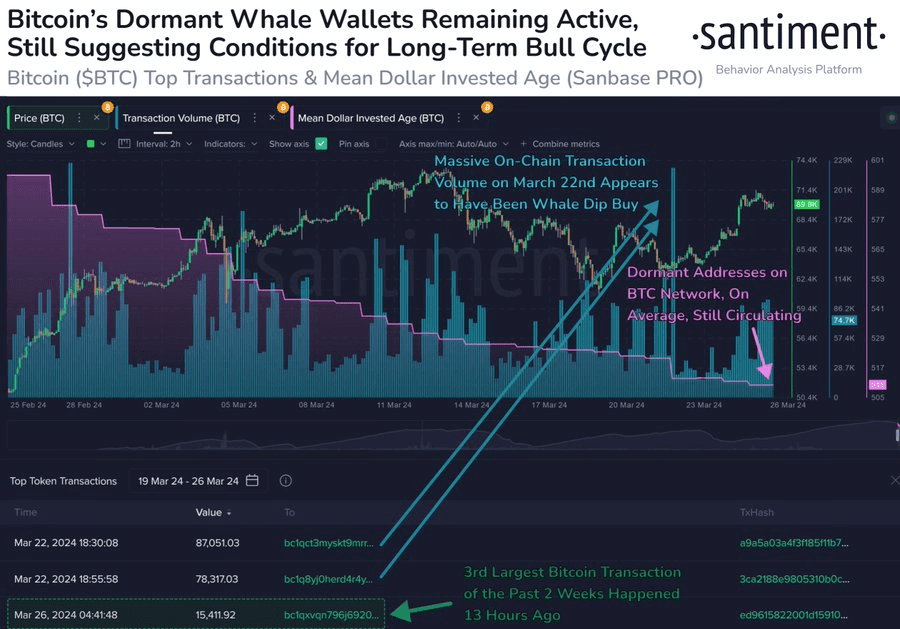

According to the popular crypto analytics firm Santiment, Bitcoin (BTC) has witnessed its third-largest transaction over the past two weeks, involving a staggering 15,411.92 BTC worth approximately $1 billion at current prices.

This massive transaction, however, pales in comparison to the two colossal transactions that occurred on March 22nd, when Bitcoin’s price dipped to around $63,000. On that day, a jaw-dropping 87,051.03 BTC (around $5.5 billion) and 78,317.03 BTC (roughly $5 billion) were moved, triggering a spike in on-chain transaction volume.

Santiment suggests that these substantial transactions aligned with significant accumulation by key stakeholders or “whales,” who seized the opportunity to buy the dip. While pinpointing the nature of the wallets involved can be challenging, these transactions appear to coincide with increased accumulation by large wallets since this past weekend.

The analysts at Santiment also highlight the significance of the “Mean Dollar Invested Age” indicator, represented by a pink line in their chart. As long as this line continues to move downward, it implies that the average age of investments is decreasing as stagnant wallets bring older coins back into circulation – a phenomenon often observed during the early stages of cryptocurrency bull runs.

In the crypto industry such substantial accumulation by whales is closely watched, as it can potentially signal the start of a new bull cycle. However, it’s crucial to exercise caution and conduct thorough research before making any investment decisions.