Why Is Bitcoin (BTC) Dumping?

- BitcoinCrypto

- April 17, 2024

- No Comment

- 32

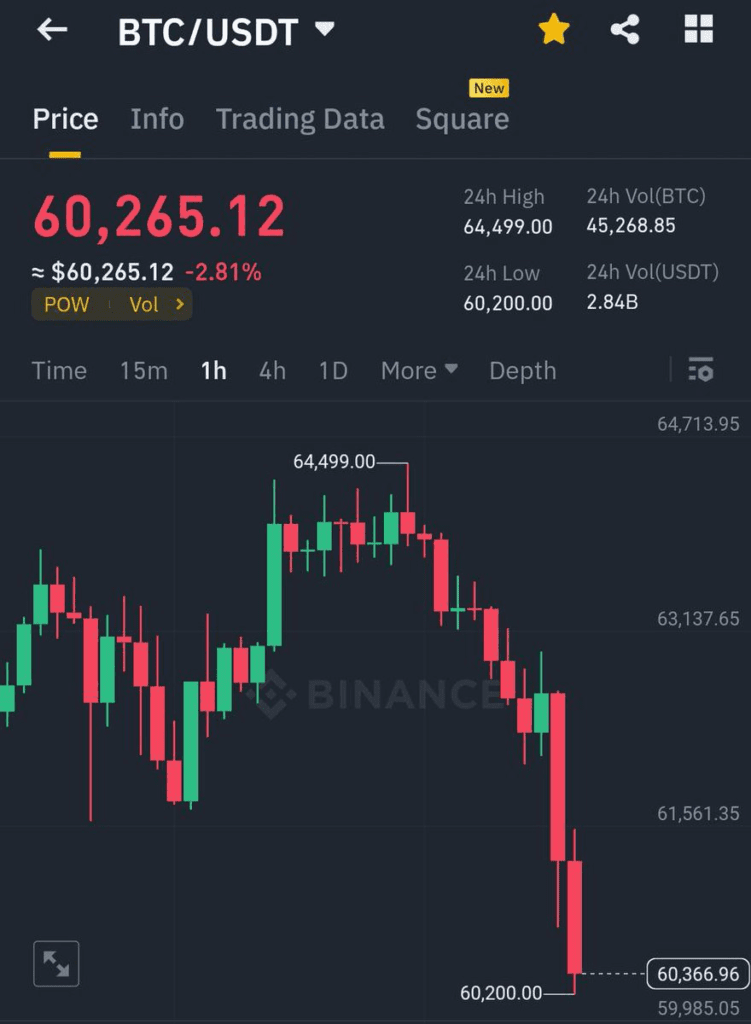

The cryptocurrency market has been rocked by a sharp decline in the price of Bitcoin (BTC), the world’s largest digital asset. BTC has plunged from a high of $71,500 on April 9 to around $60,900 at the time of writing.

The steep sell-off in the flagship cryptocurrency can be attributed to a confluence of factors, including heightened geopolitical tensions, hawkish signals from the Federal Reserve, and excessive speculation among retail traders.

Escalating Tensions Between Iran and Israel Fuel Market Panic

One of the primary catalysts for the recent market turmoil is the escalating tensions between Iran and Israel. In a startling statement, the former Mossad intelligence chief hinted at the possibility of striking Iran’s nuclear facilities. This development has raised concerns about the potential outbreak of a broader conflict, potentially even leading to a World War III scenario. The looming threat of a major military confrontation has triggered panic among investors, prompting a widespread sell-off across risk assets, including cryptocurrencies like Bitcoin.

Federal Reserve Maintains Hawkish Stance on Inflation

Adding to the market’s woes is the Federal Reserve’s continued hawkish stance on inflation. In a recent speech, Fed Chair Jerome Powell expressed ongoing concerns about elevated inflation levels, suggesting that interest rates could remain higher for longer than initially anticipated. This statement dashed market expectations of a potential rate cut in June, with some analysts even forecasting a 1% probability of an additional rate hike.

The Fed’s commitment to combating inflation through tighter monetary policy has weighed heavily on risk assets, as higher interest rates tend to diminish the appeal of speculative investments like cryptocurrencies.

Retail Greed and Excessive Leverage Exacerbate Selling Pressure

According to insights from renowned crypto analyst Ash Crypto, retail traders have displayed excessive greed and leveraged trading behavior, even in the face of recent corrections. Despite the market’s downward trajectory, funding rates (the cost of holding a long or short position in perpetual futures contracts) remained positive, indicating that traders were still heavily betting on further price increases.

Ash Crypto warns that unless there is a “full reset” or a sustained period of negative funding rates, the market could continue to trade sideways or even extend its downward trajectory.

The confluence of geopolitical tensions, hawkish central bank policies, and excessive speculation among retail traders has created a perfect storm for Bitcoin and the broader cryptocurrency market. As investors grapple with heightened uncertainty and volatility, the path forward for digital assets remains clouded, with the potential for further turbulence looming on the horizon.