Why Is Benqi (QI) Crypto Price Pumping? This Could Be the Beginning of a 10x Run

- AltcoinsNews

- May 10, 2024

- No Comment

- 182

Benqi (QI), a decentralized lending protocol built on the Avalanche blockchain, has witnessed a 25% spike in its price today. This surge has sparked speculation that it could be the beginning of a 10x run, leaving crypto enthusiasts eagerly anticipating the potential for substantial gains.

To understand the driving forces behind this price pump, it’s essential to delve into the intricacies of Benqi and its recent developments. Benqi, a decentralized non-custodial liquidity market and liquid staking protocol, allows users to lend, borrow, or earn interest using their digital assets on the high-speed Avalanche smart contract network.

Some Reasons Behind The Benqi’s QI Price Surge

One of the key catalysts for the price surge is the upcoming integration of Benqi’s native token, QI, into the Quai ecosystem. The Golden Age Testnet will mark the first time that $QI is tested within Quai, a novel blockchain designed for executing smart contracts while consuming minimal energy. Notably, $QI is a UTXO token on Quai with no programmability, and conversions between $QUAI and $QI are designed to keep $QI linked to the cost of energy.

Another significant development contributing to the price pump is Benqi’s recent collaboration with Term Labs, a flexible, scalable, and non-custodial lending protocol. This partnership allows Avalanche users to leverage their staked AVAX (sAVAX) as collateral to borrow USDC, providing them with the ability to obtain fixed rates by staking AVAX. This integration not only enhances the utility of staked AVAX but also expands the lending and borrowing options available on the Avalanche ecosystem.

The significance of this collaboration cannot be overstated, as it opens up new avenues for users to maximize their returns and unlock liquidity while maintaining their staked positions. By leveraging their staked AVAX as collateral, users can access additional capital without sacrificing their staking rewards, creating a seamless and efficient mechanism for managing their crypto assets.

Benqi Price Prediction: Bullish With Potential Upside

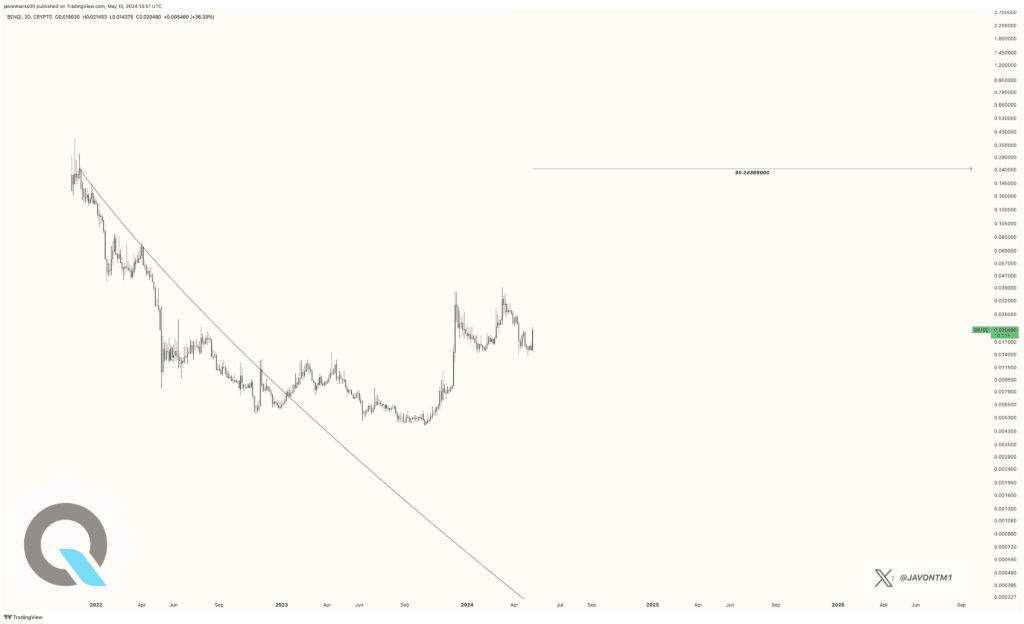

Moreover, crypto analyst JavonTM1 has added fuel to the fire by suggesting that $QI (BENQI) remains in a position where a more than 1,038% upside could still be on the way. According to their analysis, this run can already be in effect and could potentially propel prices to the $0.24365 breakout target, further amplifying the excitement surrounding Benqi’s prospects.

As the crypto community eagerly watches the unfolding events, it’s evident that Benqi’s integration with Quai, strategic collaborations, and favorable technical analysis have ignited a wave of optimism and speculation. Whether this price pump will indeed lead to a 10x run remains to be seen, but one thing is certain: the QI ecosystem is full of anticipation, and Benqi’s journey promises to be an exhilarating ride for investors and enthusiasts alike.