Ripple XRP’s Tightest Bollinger Bands in History: Potential for a Massive Price Surge or a Dip?

- AltcoinsCryptoNews

- April 20, 2024

- No Comment

- 76

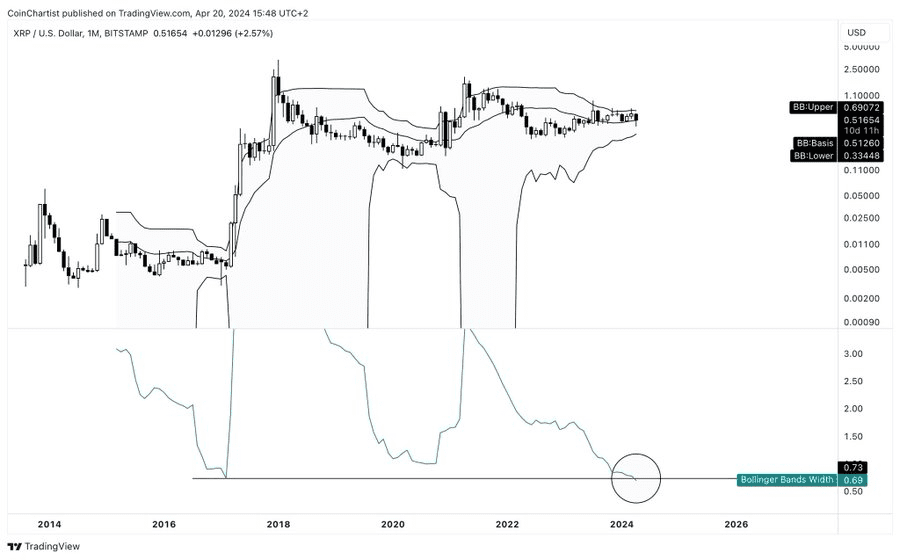

Crypto analyst Tony “The Bull” Severino has taken to X to share a tantalizing observation about XRP’s price action. According to Severino, the one-month Bollinger Bands for XRP are currently the tightest they have ever been in history. For the uninitiated, Bollinger Bands are a technical analysis tool used to measure volatility and identify potential breakouts.

Severino’s tweet draws a parallel to the last time the Bollinger Bands were this tight for XRP, which was followed by a staggering 65,000% rally. Such a massive price surge would undoubtedly be a dream come true for XRP holders who have weathered the asset’s turbulent journey.

Is XRP Going to Surge or Dip Again?

However, it’s crucial to note that the circumstances surrounding XRP today are vastly different from the previous occasion Severino references. Back then, Ripple, the company behind XRP, did not face any significant legal issues, and the broader crypto community had unwavering faith in the asset’s potential, just as they did with other leading cryptocurrencies.

Presently, XRP’s lawsuit with the U.S. Securities and Exchange Commission (SEC) has cast a shadow over XRP’s future. This uncertainty has led many Ripple holders to abandon the asset, potentially limiting the buying pressure and trading volume necessary to fuel a rally of such epic proportions. Many XRP holders have dropped the coin, so the crypto may not be able to garner enough volume to fuel the push to such an extent.

Although there is a chance for a price spike, it will likely not go as high as it did the last time. In fact, with the dropping sentiment in the XRP community, we need to be sure there won’t be a dip instead.

As with any investment, it is crucial for traders and investors to exercise caution and conduct thorough research before making any decisions regarding XRP or any other cryptocurrency. While technical indicators can provide valuable insights, they should be considered in conjunction with broader market trends, regulatory developments, and community sentiment.