Bitcoin Experts Reveal Key Prices to Watch as the BTC Market Anticipates Price Comeback

- BitcoinCrypto

- March 19, 2024

- No Comment

- 61

Bitcoin (BTC) continues to reign supreme as the undisputed king. However, its price trajectory is often characterized by volatility, making it crucial for investors and traders to keep a watchful eye on key support and resistance levels. These pivotal points can provide valuable insights into potential market movements and serve as guiding beacons for strategic decision-making.

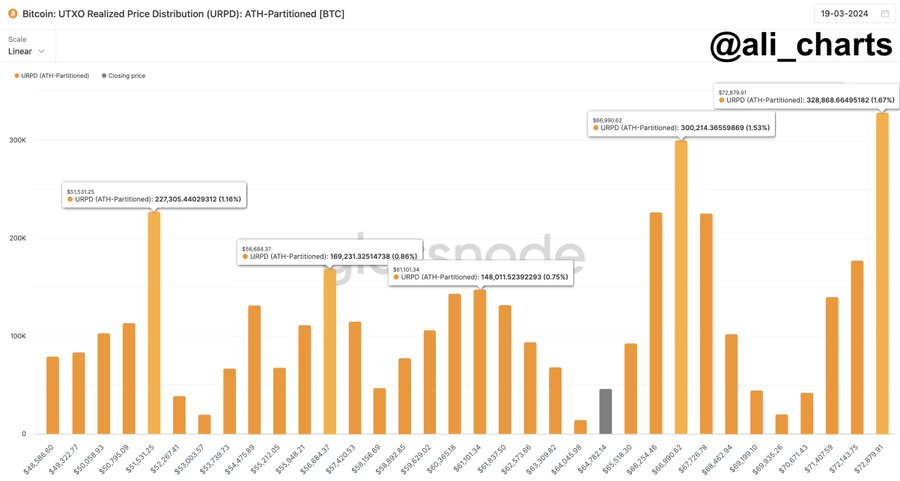

According to Ali, a prominent cryptocurrency analyst, several critical support levels for Bitcoin are worth monitoring closely. The first notable level is $61,100, which could act as a potential floor for the digital asset’s price. Should the market conditions deteriorate, this level may attract buyers and potentially halt further downward momentum. The next significant support point lies at $56,685, followed by $51,530, both of which could serve as potential entry points for those looking to acquire Bitcoin at relatively lower prices.

Ali also revealed two crucial resistance levels that Bitcoin would need to overcome to continue its upward trajectory. The first resistance barrier stands at $66,990, and a decisive break above this level could signal renewed bullish sentiment and pave the way for further gains. The second resistance point is situated at $72,880, which, if breached, could unleash a fresh wave of buying pressure and propel Bitcoin towards new heights.

Navigating the Volatile Landscape

Echoing similar sentiments, the renowned Crypto Signals account on social media emphasizes the importance of navigating the treacherous terrain between Bitcoin’s support and resistance levels. In their words, “In the volatile realm of #Bitcoin, one must tread cautiously between the support levels like $61,100 and the resistance barriers at $66,990. A strategic approach is imperative amidst this digital financial labyrinth.”

While support and resistance levels provide valuable reference points, it’s important to recognize that Bitcoin’s price movements can often defy conventional wisdom. Rekt Capital, another highly respected cryptocurrency analyst, offers a sobering reminder: “Bitcoin will retrace deep enough to convince you that the Bull Market is over And then it will resume its uptrend $BTC #BTC #Bitcoin.”

This quote shows the unpredictable nature of Bitcoin’s price action, where deep retracements and periods of uncertainty can shake even the most steadfast investors. However, Rekt Capital also suggests that these apparent bear market conditions may ultimately prove temporary, with Bitcoin potentially staging a remarkable comeback and resuming its upward trajectory.

It’s essential to understand the concepts of support and resistance levels. A support level is a price point where buying pressure tends to increase, potentially halting or reversing a downward trend. Conversely, a resistance level is a price point where selling pressure tends to intensify, potentially impeding further upward momentum.

The importance of technical analysis and identifying key support and resistance levels cannot be overstated. By closely monitoring these pivotal points, investors and traders can gain valuable insights into potential market movements and make informed decisions regarding their Bitcoin holdings.